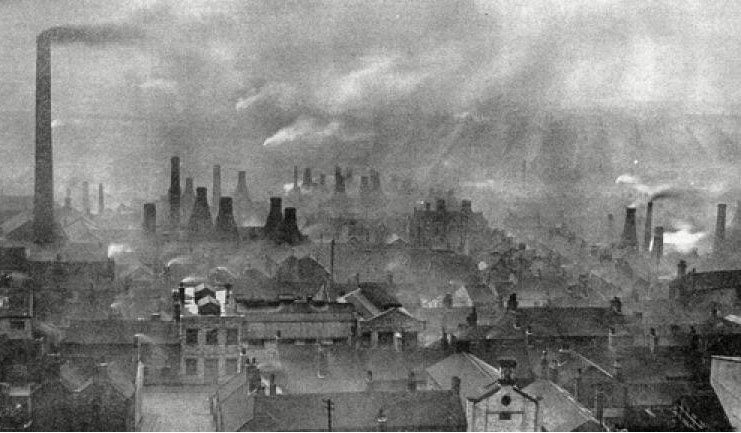

Coal powered Britain’s industrial and economic expansion during its Industrial Revolution. The abundance of coal discovered in Britain was a key factor that enabled the country’s early industrialisation, developing technologies and industries unfeasible elsewhere due to the lack of cheap energy sources. The British Empire’s expansion was partly driven by the need for other resources and labour to fuel this industrial growth, leading to the exploitation of natural resources in colonised regions.

The demand for coal intensified as the British economy expanded, and the empire’s infrastructure, such as steam-powered railways and ships, was largely powered by coal. This infrastructure extended the empire’s colonial expansion and exploitation of resources.

The British Empire’s decline after World War II coincided with significant economic changes in the UK. As the empire contracted, the UK faced economic challenges that necessitated a shift in industrial focus. The coal industry, which had been a cornerstone of the British economy during the height of the empire, began to decline as the UK sought to modernise its economy and reduce reliance on traditional industries. As the empire declined, the UK faced increased competition from other countries that were industrialising and developing their own energy resources. This competition, combined with the high cost of domestic coal production, made coal less economically viable on the global market. These market conditions made it possible for Margaret Thatcher, then Prime Minister, to rapidly and infamously dismantle coal mining in the UK, closing 159 coal mines 1984-1994.

The Clean Air Act of 1950 and later environmental policies further accelerated the decline of coal. The “Dash for Gas” in the 1990s, driven by the repeal of restrictions on gas use in power stations, further reduced coal’s share in the energy mix. In the 2000s, improvements to battery storage, increasingly cheaper renewable energy technologies, and carbon credit schemes, made coal progressively uncompetitive and unnecessary.

The decline in coal mining in the UK and the slower decline of coal use means the UK became increasingly dependent on coal imports, often from former colonies and poorer regions of the world. The colonial dynamics of this was increasingly centred by activists in the UK in grassroots resistance to ongoing coal dependency. Activists highlighted that the UK’s continuing use of coal in the UK had a double effect of inflicting on the global south; off-shoring localised environmental damage and displacement from coal mining, and then the worst consequences of climate change that burning that coal would return to those communities. The widely publicised climate camps and grassroots campaigning helped shape an increasingly negative public perception of coal. This, together with declining reliance on coal, coincided with a new UK Labour Government policy in 2009 that any new coal-fired power station would need to be fitted with carbon capture and storage. This technology was so expensive and largely ineffective that it effectively deterred any proposals for new coal-fired power stations. With existing and ageing coal-fired power stations coming to the end of their operating lives over the 15 years that followed, and now no coal-fired prospects to replace them, the Conservative Government that inherited this decline set in motion by the previous Government’s policy, branded it a new climate commitment to remove coal from the UK’s energy mix by 2025, later brought forward to 2024.

That brings us to Ratcliffe-on-Soar, that UK’s last coal-fired power station, fated to close at the end of September 2024, ending an era of coal-fired power generation in the UK. Coal used for other industrial purposes such as steel manufacturing and cement production are also a focus of decarbonisation efforts and public subsidy. As the UK moves away from the coal it used to rely upon, existing coal mines in the UK – most notably Aberpergwm, which is licenced to operate until 2039 – would need to export its coal to maintain sales. This could risk returning to a colonial dynamic where the UK benefits from dumping resources on developing countries that are considered unfit to use domestically due to air pollution and other factors.

Published: 17. 09. 2024

The public consultation window for the National Policy and Planning Framework represents the first opportunity since the new UK Government was formed to stop any new coal mine application winning planning permission across England. This sweeping change would go a long way to ruling out any new coal mines in the country.

For the last year we have been working behind the scenes to persuade political parties to commit to banning new coal mines in the UK. Thanks to our work, 5 major parties in Parliament committed to this in their manifestos, including the new UK Government.

One of the first actions the new Government is taking is to reform the National Planning Policy Framework. Their main focus is on building more houses and renewable energy projects. But one part of the NPPF advises local planning authorities on whether they should grant permission to applications for more coal extraction. Currently, the guidance is vague which and open to expensive legal challenge from mining companies which can make planners wary to refusing permission to new coal mine applications.

We know new coal extraction must be stopped, and we want the UK Government to ensure that happens in this reform by providing the clear direction planners need to confidently say NO to new coal mine applications.

The Government is running an open consultation on their proposed reforms until September 24th. The more folks who write in, the harder it'll be for the UK Government to ignore your collective call to draw the line in the sand right here, right now. Help us end coal mining in England by using our form to respond.

ERI Ltd launched its pre-application consultation in early 2024 to mine two coal tips in Bedwas, South Wales. The company is proposing to extract a total of around 468,000 tonnes of coal from both tips. This would drive further climate chaos by over 1.3 million tonnes of CO2, as well as devastate the coal tips’ natural regeneration over the past 30 years since it was abandoned. The project also endangers the beautiful Sirhowy Valley Country Park bordering one of the tips. ERI Ltd claims it would use some of the profits from the coal mining to restore the coal tips afterwards. This amounts to more coal mining to clean up the mess left by old coal mining—we’ve been here before with the nearby Ffos-y-fran site, and we know it doesn’t end well.

With over 300 category D coal tips in South Wales alone, ERI Ltd’s proposal could trigger a new wave of coal mining if it were successful. For the sake of localised impacts and our collective climate, we are therefore committed to challenging an application by ERI Ltd every step of the way, together with the local community resistance, Sirhowy Valley Country Park support group, Good Law Project, Friends of the Earth Cymru, and Climate Cymru.

Regular safety monitoring is considered sufficient for most category D coal tips abandoned by the coal industry in South Wales. But for coal tips that pose a danger to nearby communities, more coal mining isn’t the solution—we need swift remediation sensitive to local ecologies and lives. These diverse fungi were spotted by a local resident on a single walk nearby the coal tips:

The Senedd’s Climate Change, Environment, and Infrastructure Committee (CCEIC) has released a critical report on the management of opencast coal mining in Wales, particularly focusing on Ffos-y-Fran, one of the last opencast coal mines in the region. The report describes Ffos-y-Fran as a “symbol of the system's failures”, highlighting significant shortcomings in oversight.

The CCEIC specifically calls out Merthyr Tydfil County Borough Council (MTCBC) for its inaction regarding illegal mining activities that continued after the mine's license expired in September 2022. The report questions whether MTCBC could have done more, noting the Coal Authority's concerns about the lack of a robust closure plan.

Local residents have expressed deep concerns about their treatment by public authorities. The committee emphasized the need for improved transparency and engagement, urging MTCBC to involve residents in the revised restoration plan.

Campaigner Chris Austin welcomed the report, stating it offers strong recommendations for policy changes regarding coal mine restoration. He expressed hope that the findings would lead to better outcomes for Ffos-y-Fran and prevent future issues.

We praise the CCEIC for investigating the failures that allowed illegal mining to occur without repercussions. The focus now must be on the Welsh Government and Merthyr Tydfil County Borough Council implementing the committee’s concrete recommendations to restore justice to affected communities.

Among the 26 recommendations (see below for a full list), the CCEIC calls for the Welsh Government to ensure that policies on opencast coal mining are robust and protective of local communities. The Coal Action Network advocates for a clear ban on coal mining in Wales, similar to Scotland's 2022 decision, to prevent mismanagement in the future.

The report serves as a crucial reminder of the need for accountability and proactive measures in managing natural resources in Wales.

Own emphasis

Fantastic news today, 20th June 2024. The UK Supreme Court has set a historical precedent, in overturning a previous ruling, considering the legality of approving a new oil site in Surrey.

The ground breaking decision stating that 'downstream' emissions (those released when a product is used) must be factored into decisions on whether to approve or reject planning applications for projects to extract those fossil fuels. It was a contentious decision within the Supreme Court with a 3-2 decision amongst the judges presiding over the case.

Not only will this decision stop this oil drilling from going ahead, it also sets a precedent against all UK fossil fuel extraction!

Consequently this decision should have a big impact on the upcoming West Cumbria coal mine legal challenge in the Court of Appeal 16th to 18th July.

There are 5 unique grounds that South Lakes Action on Climate Change and Friends of the Earth are appealing the decision to approve a 2.8 million tonnes a year coal mine to operate until 2049.

The reasoning for the decision against the Horse Hill project should directly impact two of these grounds against the approval of the West Cumbria coal mine. If the Court of Appeal agrees with any one ground, then the current planning permission will be overturned and the next Government will have to decided afresh whether to allow coal mining in Cumbria.

The Judges were clear in their ruling, “The whole purpose of extracting fossil fuels is to make hydrocarbons available for combustion. It can therefore be said with virtual certainty that, once oil has been extracted from the ground, the carbon contained within it will sooner or later be released into the atmosphere as carbon dioxide and so will contribute to global warming. This is true even if only the net increase in greenhouse gas emissions is considered. Leaving oil in the ground in one place does not result in a corresponding increase in production elsewhere”

The grounds in the West Cumbria coal mine legal challenge this new decision impacts challenges are:

1) errors of law concerning whether ‘downstream emissions’ caused by the coking coal were indirect significant environment effects of the proposal.

2) error of law and/ or failure to give understandable reasons concerning substitution.

Cornerstone Barristers who acted on behalf of Sarah Finch and the Weald Action Group said, "the Court noted that the direct GHG emissions over the lifetime of the project had been described as having a “negligible” effect on the climate. By contrast, the Court considered that the downstream GHG emissions (which would have been nearly two orders of magnitude greater), “could not have been dismissed as “negligible” in that way” (§82)."

The Horse Hill oil well was expected to release over 10 million tonnes of CO2. The coal proposal at West Cumbria was expected to release slightly less than that each year. West Cumbria Mining Ltd who are behind the proposed mine, claim the mine would be net zero, by paying for carbon offsetting.

To divorce the production and supply of fossil fuels from the emissions of their use is a dangerous fiction. At Coal Action Network, we know the simple truth that when fossil fuels are extracted they are used. We also know that abundance and reliability of supply encourages reliance and discourages investment in alternatives.

Five political parties have ruled out new coal extraction ahead of the election. It's clear to the majority of the UK's political leaders that limiting the supply of fossil fuels is vital to reduce their use, and they're pledging to take action on that. With the ruling in the courts today reinforcing that message. It is obvious to most people - fossil fuel producers have responsibility for the climate catastrophe created by their consumption. It's time to put to bed the absurdity of a 'climate neutral', or even 'climate-negative', coal mine as the proposed Whitehaven coal mine pretends to be.

“...we will not grant new coal licences and will ban fracking for good.”

Manifesto in full

“Maintaining the ban on fracking and introducing a ban on new coal mines.”

“Cancel recent fossil fuel licences such as for Rosebank and stop all new fossil fuel extraction projects in the UK.”

“Ban new coal licences. Follow the SNP Scottish Government’s lead and commit to no support for new coal mines, which would undermine our action to reach net zero.”

“...are opposed to... new open cast coal mines. Opencast mine sites should be fully restored for the benefit of local communities, and should never be used as a guise for private companies to undertake further coal extraction.”

The Labour Party's manifesto pledge “we will not grant new coal licences and will ban fracking for good.” follows a year of inside-track and public campaigning by Coal Action Network in the UK parliament and Welsh Senedd.

The UK’s last coal-fired power station closes this year, and last year is confirmed the hottest year on record. We’re pleased that the Labour Party has listened to our arguments, along with the Liberal Democrats, the Green Party, Plaid Cymru, and Scottish National Party which have also ruled out any new coal mining.

We'll work with whichever party forms the new Government on turning a policy ruling out new coal licences into a stronger statute. We hope the new Government will also address existing coal licences – for both operating mines, such as Aberpergwm (permission to mine until 2039), and proposed mines such as West Cumbria (permission to mine until 2049). The West Cumbria coal mine is an example of how coal mine licences can slip through the coal regulator, even when there is no domestic demand for the coal and it'll be exported to drive further climate chaos.

Coal is still the number one fossil fuel driver of climate change globally - we must lead my example, and a policy ruling out any more licences for coal mining is just that.

Published: 17. 06. 2024

Coal Action Network asked Who will stop coal? last weekend in Whitehaven, West Cumbria. At the site of the proposed coal mine, members of the local community and supporters gathered to ensure that the question of the mine is being put to election candidates. Now we need you to crank up the pressure and make sure all election candidates across the UK faces this question as they could decide the fate of the coal mine if elected and legal challenges to the mine are successful next month...

The next Government may have the opportunity to not only stop the West Cumbria mine, but legislate an end to coal mining in the UK forever. We will be working hard behind the scenes to make that happen - but, the more you can help us, the better. Join us in writing to your local candidates (automatically selected) - this could be the first step in them helping to end coal mining in the UK for good.

'Energy Recovery Investments Ltd' is proprosing to extract coal from large coal tips created by the Bedwas Colliery (1913 - 1985) in Bedwas, Caerphilly, South Wales over an operational period of 7 years (but this is often extended later). The company claims that it would use some of the sales of the coal to restore those coal tips afterwards. Based on historical estimates, the total volume of the Tips is approximately 5,000,000m³ which equates to around 8,500,000 tonnes of colliery spoil. The company claims that it expects to haul 468,000 tonnes of coal off the site via 20-tonne heavy goods vehicles (HGVs), driving further climate chaos by over 1.3 MILLION tonnes of CO2.

The Tips are classified as Category D which is defined as “A tip with the potential to impact public safety, to be inspected at least twice a year.”. The main risks associated with Bedwas are understood to be risk of tip fire and contamination of local watercourses (including Rhymney River), with land stability being of a lesser concern.

'Energy Recovery Investments Ltd' has not disclosed what proportions of coal will be sold to which market but does indicate "ERI’s proposal is to sell on these stockpiles of coal to heavy industry, the cement manufacturing industry and potentially energy production industry...", and elsewhere cite the steel sector and brickworks as potential customers.

The company would need to build a new section of haul road 575m long and 6m wide cut into the rock, and widen the existing forest track - possibly at the loss of trees bordering the road. It would involve works on setting up the site starting at 6am and continuing into the night until 10pm (16 hours/day, 15 hours every Saturday, and only Sunday without works) for 6-9 months (but this is likely to be extended, as is common for projects like this). Outside of these hours, maintanence works could still occur, according to the company. The company estimates an average of 90 hauls by HGVs per week to occur over the seven years operational period. This is equivalent approximately to 18-20 hauls HGVs going to and from the site every day.

The coal tips lie above a coal seam, which the company claims it would coincidentally have to dig into to create 'lagoons' for processing the coal from the coal tips. That's right, Energy Recovery Investments Ltd claims it needs to mine the coal in the seam, creating a further coal tip, in order to mine the coal in the coal tips already created. The company is trying to rebrand the coal mined from the tips and from digging the lagoons, as 'reclaimed' and 'incidental' coal respectively, in an attempt to get around Welsh Government policies against further coal extraction.

Energy Recovery Investments Ltd creates a new name for the coal it proposes to mine: "Reduced Carbon Coal" - a name based on the claim it could displace coal imported with the associated travel miles. This is an old argument that has been debunked many times. See our video with Economics expert, Prof. Paul Ekins or our myth-buster.

The company is so keen to distance this project from a coal mine, it has gone into greenwash overdrive - refusing to even call a coal washery by its normal name, and instead rebranding it as a "beneficiation/processing plant.

With absolutely no evidence or calculations, Energy Recovery Investments Ltd makes the outlandish claim in its planning statement that any, eventual and additional, 'carbon sink' like properties of the site after operations have finally ceased may offset the processing and extraction of the coal, transport by deisel HGVs, and end use.

Energy Recovery Investments Ltd presents the mining of coal as "a beneficial by-product of the tip reclamation process". It's the very objective of this company to generate a profit for itself from the mining of the coal tips - it is very far from being a by-product.

Energy Recovery Investments Ltd claims that a proportion of its coal will be used at steelworks, necessary for green infrastructure - a common argument which is even less true today than it was previously, as both virgin steelworks in the UK converts to using processes for producing steel from scrap that doesn't rely on coal inputs, ending the UK steel market for coal.

Energy Recovery Investments Ltd is a small company with assets valued at £114,000 in its 2022 annual financial accounts on Companies House – but only £9,000 cash assets. This is concerning as there would be limited scope to recover damages if mistakes are made or the company refuses to remediate the coal tips after extracting profitable coal from them.

The company was registered in 2008 and “the principle activity of the company is the recovery of coal from redundant coal tip sites”. But since 2012, the company has idled with zero staff until employing just 2 staff a decade later in 2022. Energy Recovery Investments Ltd has only operated one other site, in 2008, Six Bells and Vivien Tips near Abertillery, South Wales - which it extracted 260,000 tonnes of coal from over 2.5 years, by subsequently getting permission to opencast coal mine one end of the site.

Despite all its efforts to distance itself from coal mining, Energybuild Ltd (the coal mining company at Aberpergwm) has previously been a major shareholder in Energy Recovery Investments Ltd.

ERI Ltd is the wholly owned subsidiary of PPM Holdings Limited, a company incorporated in just 2022 with no published company accounts and currently registered as a ‘non-trading company’. The current Director of PPM Holdings Limited, Sian Thomas, was previously Director of Green Steel Works Ltd, which deals with ‘Remediation activities and other waste management services’ and is the official office address for Energy Recovery Investments Ltd. This kind of complicated and confusing corporate structure is typical of mining companies, and has been used in the past to evade corporate accountability. The other Director of PPM Holdings Limited is Mark Harvey, is a Director of 6 companies dealing with mineral waste disposal and storage, and real estate.

This proposal has strong similarities with the sprawling Ffos-y-fran opencast coal mine. The sale of the coal from this mine was to pay for the restoration of a neglected hill in Merthyr Tydfil to the extent the coal mine was even branded as the "Ffos Y Fran Land Reclamation Scheme". Yet, the profits from 16 years of coal mining has been put of reach, and the local Council faces up to £120 million shortfall to pay for the much greater restoration works now needed. We don't want Bedwas to become the next Ffos-y-fran disaster.

With over 300 at-risk coal tips registered across South Wales, and financial shortcomings to pay for their remediation, the concern is that the Bedwas coal tip is a testing ground for remediating the remaining coal tips. This would be disasterous for our climate and represent total contempt for the Wellbeing of Future Generations Act. The company has presented a planning statement littered with the tired justifications of mining companies. Stay tuned as we ask for your help in this campaign.

The Crown Prosecution Service has dropped all charges against the four Extinction Rebellion (XR) activists who blockaded the entrance to the UK’s largest open-cast coal mine, last summer with a pink boat.

While removing the immediate burden of legal confrontation for the defendants, the decision has left a “crater of unfinished business” in the fight for climate justice and accountability for local residents..

“The action was always designed to have a much deeper impact beyond the immediate disruption with a pink boat,” explained Liz Pendleton, one of the four defendants who occupied the site for over 24 hours in July 2023. “It was designed to expose the alleged illegal activities and environmental negligence of the mining operation, in particular, its continued operation beyond permitted planning conditions and contradictory and misleading financial statements which may well constitute fraud.”

The Ffos-Y-Fran mine in Merthyr Tydfil, Wales had been operating without a licence for almost ten months when XR activists took direct action.

“By denying us our day in court the CPS has denied us the opportunity to shine a light on this potentially illegal and criminal operation,” said Liz.

The legal proceedings revealed a shocking lack of cooperation from the mine, including failure to provide basic operational logs, communications between the mine and governmental bodies, and internal documents relating to the financial and environmental management of the mine's operations. This critical information would have shed light on the legal position of the operation and whether funds had been set aside for environmental restoration - which was a condition for the getting the go ahead in the face of overwhelming local opposition. The defendants were also confident this would have led to their acquittal.

The dropping of the case also casts doubt on the legitimacy of the arrests, as in the case of aggravated trespass the police can clearly be seen acting in the interests of corporate bodies who then fail to prove that they themselves were carrying out lawful activities.

The discontinuation of charges is a testament to the strength of the activists case and the shaky foundation upon which the mine's operations stood, explained Raj Chada from Hodge Jones & Allen, representing the defendants:

“In seeking disclosure from the CPS, we highlighted the need for transparency on several critical points. Our requests were aimed at uncovering potential evidence of the mine operating beyond legal scrutiny, which raises concerns about the legality of its operations. The CPS's inability to meet these disclosure obligations casts a shadow over the proceedings and suggests that the depth of the mine's legal and environmental mismanagement may be greater than previously understood.”

For over a decade and a half, the Ffos-Y-Fran mine has been a symbol of the environmental and social challenges that face communities at the ‘coal face’ of climate degradation. The abrupt end to this case marks not a clear-cut victory but a complex milestone in the ongoing struggle. While it spares the defendants the strain of a continuing court battle - already exceeding seven months in duration - it denies the platform to publicly expose the depth of negligence and alleged fraud by the mine's operators, Merthyr (South Wales) Ltd., including their failure to fulfil obligations towards land reparations and the creation of green jobs.

Speaking upon hearing the news, local resident and defendant Marcus Bailie commented: “Our fight was not just against the physical act of coal extraction but against disregard for the land's future and the community's well-being. The piles of coal and the colossal scar on the landscape left behind serve as stark reminders of the environmental impact that has yet to be addressed. The real victory would have been to hold those responsible to account in a public forum, forcing a reckoning with the consequences of their actions.” Marcus went on to say, “We’re not the criminals here!”

Chris and Alyson Austin, residents of Merthyr Tydfil who have been campaigning for years for the mine to be closed said: “We feel angry and betrayed about the waste-land they have left behind.”

The bittersweet outcome underscores the resilience and dedication of activists and the broader environmental movement. It also highlights the complexities of seeking justice in a system where procedural technicalities can overshadow substantive issues. The fight for the Ffos-Y-Fran mine was never just about legal vindication; it was about bringing to light the injustices inflicted upon nature and communities - and campaigners promise, it won’t end here.

For further information, quotes, or to arrange interviews, please contact: press@extinctionrebellion.uk | +44(0)7756136396

On 23 October 2023, over 30 Wales-based NGOs, businesses, and community groups signed an open letter to Wales’ Climate Change Minister, Julie James, calling for the Welsh Government to ban coal mining once and for all (sent by Climate Cymru). On 10th January 2024, Julie James wrote back—but claims a ban isn’t needed, even though 1.6 million tonnes of CO2 could have been prevented since 2022 if the Welsh Government had adopted a ban. That failure has caused 362 additional deaths from climate change related causes. Julie James’ claims just don’t stack up against those lives lost. Here’s why:

The open letter to Julie James highlighted that an issue with the current policy is that it is riddled with caveats and exceptions. Carmarthenshire County Council’s Planning Officer even wrote in September 2023 that it was “difficult to know for certain how to interpret the coal policy”. Julie James failed to respond to this point entirely. A clear ban would remove the existing ambiguity that makes the current policy challenging to apply.

Julie James also did not respond to our point that Merthyr (South Wales) Ltd would not have been able to mine 500,000 tonnes of coal from Ffos-y-fran over the past 1.5 years if there was a clear ban on coal mining. The mining company exploited the exceptions in existing policies to secure a de facto extension. To protect against this climate assault recurring by closing the loopholes, a clear coal ban is needed now.

In the open letter to Julie James, it’s stated “A coal mine ban can be drafted is such a way that allows for the safe winding down of existing coal mines, and Coal Authority access to fulfil its regulatory duties”. That didn’t stop Julie James trying to use that against a ban anyway: “we also have a duty to manage the safe closure and restoration of existing and historic mining infrastructure”. Julie James accompanies this with a reason that’s even more bizarre: “The incidental extraction of limited coal may also be required during the construction of infrastructure projects”. Those wouldn’t be coal mines so wouldn’t fall under a ban—the Coal Authority even licences this differently as an ‘incidental coal agreement’. The burden and hazards of historic mines across Wales would diminish under a coal ban, rather than risk being added to—a very real risk in light of Ffos-y-fran.

Julie James says “…coal licences may be needed in wholly exceptional circumstances and each application will be decided on its own merits”. But this creates exactly the problem that Julie James lamented in her letter in October 2011 to then Minister for BEIS Kwasi Kwarteng: "both the developer and the Coal Authority committing significant resources respectively to preparing and determining applications... before Welsh policy can properly be applied”. A coal ban would end the pipeline of applications, and the private and public funds they waste.

Julie James twice hails “the presumption being against extraction” in current policies. We hope it’s not presumptuous to argue for a commitment stronger than a ‘presumption’ in the face of catastrophic climate change. What justification could opening a new coal mine have in the face of the 362 lives that’ll be cut short due to the Welsh Government’s refusal to ban coal mines up until now? Climate vandalism over the past year shows nothing short of a ban on coal mining can protect the lives and ecosystems at stake.

Finally, Julie James concludes her letter by claiming the “Welsh Government has adopted and implemented the strongest policy opposition to coal extraction across the UK Governments”. Even if that were true, the Welsh Government clearly needs to go further given current policies have failed to prevent 1.6 million tonnes of avoidable CO2 in the past 1.5 years. But it’s also not true. Julie James’ claim to be leading on a progressive coal policy is based on her comparison to a similar one set out in the Scottish Parliament back in November 2021. She ignores the de facto ban that the Scottish Government more recently introduced in October 2022—as referenced in the open letter to Julie James. If Julie James actually wants the Welsh Government to boast the strongest policy opposition to coal mining, she’ll have to be bolder by committing to a ban on coal mining in Wales.