Each year, the UK government releases a Digest of UK Energy Statistics (DUKES) report. The most recent was released in July 2022, covering the year 2021.

The steady decrease of coal in recent years was not so pronounced between 2020 and 2021. There was a record low use of coal for energy generation in 2020. In 2021, coal increased slightly to provide 2.8% of UK electricity demand.

This article looks at the trends in the coal industry and unless otherwise stated, is based on DUKES 2022.

Demand

Overall energy consumption in 2021 remained low, up on 2020 levels but down 9% on 2019. Consumption of coal and coal derivatives rose by 4% during 2021. Demand for coal rose slightly in 2021, by 3% to 7.3 million tonnes compared to 2020.

Consumption of coal for electricity generation rose 14% to 2.7 million tonnes in 2021, although this was from a record low baseline in 2020. The increase was partly due to a fall in renewable electricity generation and maintenance outages in nuclear plants.

There were 3 coal powered stations operating in 2021 - Ratcliffe on Soar, West Burton, and Kilroot. Drax power station’s coal units were mothballed in March 2021, but will be on standby in winter 2022/23, more info later.

Production

Production of coal fell to another record low in 2021, down 37% from 2020 to 1.1 million tonnes. In 2021, 14% of demand for coal was met by domestic production (of which 9% came from 5 deep mines), 48% by net imports, and 38% was drawn from stocks. Opencast mine production fell 39% to a record low of 1 million tonnes due to mine closures, production restrictions due to Covid-19 and flooding. Three opencast mines were operating in 2021. Between 2011 and 2021 UK coal production has fallen by 94%.

Imports

In 2021 net imports accounted for 48% of the UK’s supply of coal. 2.4 million tonnes of coal for power stations was imported, accounting for 53% of total coal imports. Coking coal imports were up 2.6% at 2.1 million tonnes compared to 2020.

Coal imports rose 1.7% from 2021 and 2020 to 4.6 million tonnes. Four countries accounted for 85% of total coal imports: Russia (43%), the USA (24%) Australia (11%) and Venezuela (7%), with other significant coal quantities coming from the EU, Colombia and South Africa.

| Extract of Table 2.7 UK imports of coal in 2021, (thousand tonnes) | |||||

|

Steam coal |

Coking coal |

Anthracite |

Total |

||

| Russia |

1,121 |

827 |

20 |

1,968 |

|

| United States of America |

388 |

739 |

0 |

1,128 |

|

| Australia |

0 |

511 |

0 |

511 |

|

| Venezuela |

319 |

0 |

0 |

319 |

|

Stocks

Coal stocks fell to 1.7 million tonnes in 2021, which was 62% lower than in 2020, as a result of burning more coal than the UK both imported and mined domestically.

Coal available to be mined

As of June 2022, the Coal Authority estimates that, overall, there are 3,814 million tonnes of coal

resources still underground across the UK. Of the economically recoverable and minable coal resource in current operations (including those in the planning or pre-planning process), 986 million tonnes is in underground mines and 46 million tonnes in surface mines. England and Wales had an 84% share of current UK coal mines and licenced resources, followed by Scotland with 9%. There are none in Northern Ireland.

Demand for coal in 2021 was 2.8% greater than in 2021 at 7.3 million tonnes. Much of this increase was driven by the 14% rise on 2020 levels in coal-fired generation to 2.7 million tonnes, although this was from a low baseline following record periods without coal generation in Great Britain in 2020.

Industrial coal use

The iron and steel industry is one of the main non-electricity generation users of coal. Coking coal is used for coke manufacture, in blast furnaces and direct consumption. In 2021, iron and steel production used 2.6 million tonnes of coal, half of what it used in 2015. In terms of total share, it comprised 36% of UK coal consumption in 2021, up from 14% in 2015, because the whole coal market shrunk, but more rapidly coal for power stations. Total coal consumption by industry rose by 4.7%, although the transformation for coke manufacture and in blast furnaces fell by 6.3%.

Exports of coal

| Coal type | thousand tonnes |

| Steam coal | 1,018 |

| Coking coal | 4 |

| Anthracite | 107 |

| Total | 1,129 |

The UK Government’s commitment to the 2024 phase-out of coal use in energy generation is mentioned several times in the DUKES report. Ending of coal mining, imports and coal used in industry is not included in the phase-out plans.

Outside of the scope of the DUKES report is the Government’s request to Drax, Ratcliffe and West Burton power stations to extend the life of their power stations until March 2023. Drax was due to close its 2 coal units and convert the former coal power station entirely to biomass after September 2022. Under new agreements, the units would only operate if and when instructed to do so by the National Grid when electricity supply would otherwise be low.

Coal is being used as a backup due to Government concerns over gas supply and energy security, but could undermine the coal phase-out while additional contribution of greenhouse gases is a certainty, as coal produces more carbon and methane per MWh than any other fossil fuel or biomass. It is likely that more coal will have to be imported in order to be in stock to burn if the power stations are turned on. It is not clear what will then happen to these stocks if they are not needed this winter.

As part of our Politics Unspun series we are unpacking politicians’ public comments on coal to challenge any misleading or incorrect messages. Todays’ focus is on comments made during a Westminster Hall debate in December 2025 about the oil refining sector. During the debate, Lee Anderson MP made some statements about coal…

The Government is reforming planning policy in England and thanks to thousands of our supporters asking for an end to coal extraction in the last consultation in 2024, they are now recommending that planners “should not identify new sites or extensions to existing sites for peat or coal extraction”…

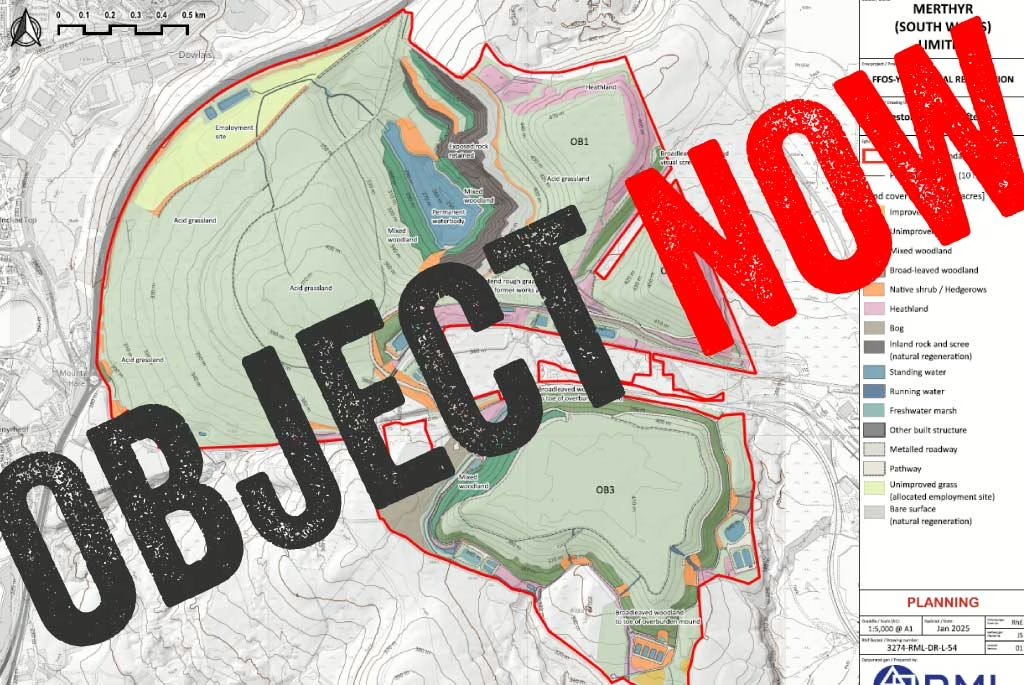

Merthyr (South Wales) Ltd mined for over a year illegally after planning permission for the Ffos-y-fran opencast coal mine ended in September 2022. During that year, it made record-breaking profits due to sanctions on Russia and other factors driving up the price of coal. But rather than using some of the profits from that ill-gotten coal…

In November 2024, the new UK Government announced its intention to legislate a ban of new coal mining licences – which we welcomed. Over a year later, the legislation is yet to be introduced, and the Government is not planning to include all types of extraction…

The UK steel and cement sectors (and to a lesser extent, bricks) are the largest users of coal following the closing down of the UK’s last coal-fired power station in September 2024. Check out our coal dashboard for our most recent coal stats including an industry break-down. We support the UK Government’s commitment to ban…

The steel industry produces 9-11% of the annual CO2 emitted globally, contributing significantly to climate change. In 2024, on average, every tonne of steel produced led to the emission of 2.2 tonnes of CO2e (scope 1, 2, and 3). Globally in 2024, 1,886 million tonnes (Mt) of steel were produced, emitting…

Last month we worked with Members of Parliament from various parties on a Westminster Hall debate about coal tip safety and the prohibition of new coal extraction licences. The debate happened 59 years and one day after the Aberfan tragedy which killed 116 children and 28 adults…

Successful, at-scale, examples already exist of cement works burning 100% fuel alternatives to traditional fossil fuels, including pilot projects using combinations of hydrogen and biomass (UK) and hydrogen and electricity (Sweden). Yet, innovations such as use of hydrogen and kiln electrification are…

Within the borders of the Senedd Caerphilly constituency is the proposed Bedwas coal tips re-mining project. In the lead up to the Senedd by-election, Coal Action Network has carried out a survey of the by-election candidates asking for their views about the re-mining of the Bedwas and other…