The recent Digest of UK Energy Statistics shows the coal situation for 2022. All unreferenced statistics come from this report and appendices.

Coal was bought by power stations last year in order to fulfil unexpected, short term contracts with the government worth £420 million to extend power station's lives while air quality environmental regulations were not enforced.

In 2022, coal mined in the UK mainly came from opencast coal mines. Production was down on previous years. Now, in September 2023, there is only one operating opencast coal mine, the illegal Ffos-y-fran mine. There is one significant sized deep coal mine; Aberpergwm colliery in Neath Port Talbot, which has been granted permission to expand. From this date there is only one coal power station available to generate electricity, down from 4 last year.

While overall energy demand in 2022 was stable compared to 2021, demand met by coal in the energy mix fell by 15% compared to 2021, to 1.60% of total electricity supply. Wind, solar and hydro energy production rose to a record high level due to increased capacity and more favourable weather conditions, but unfortunately consumption of both gas and nuclear energy were also up.

Coal use in power stations has dropped dramatically since 2012, when 43% of electricity in the UK grid was produced from coal combustion. However, 4 coal power plants remained operational throughout 2022. Drax and West Burton power station's coal units were due to be closed before the end of 2022, but the UK Government paid £420 million to extend the operational lifespan of the coal units over winter 2022 into 2023. Coal stocks were 10% higher than in 2021 to facilitate this. Drax didn't operate in 2022 and is now decommissioning its coal units. It remains a high carbon power station, though, as it burns imported wood as biomass.

4 coal power stations operated in 2022. Now only Ratcliffe-on-Soar remains available to the grid.

Ratcliffe on Soar power station is due to close in September 2024.

In early 2020, Drax power station said there would be "formal closure of the coal units in September 2022". Decommissioning actually started in 2023, after the UK Government paid the power station to be on standby with coal during last winter. Drax did n't operate in 2022 and is now decommissioning its coal units. It remains a high carbon power station as, though, it burns imported wood.

n't operate in 2022 and is now decommissioning its coal units. It remains a high carbon power station as, though, it burns imported wood.

Kilroot coal and oil power station in Northern Ireland is to be converted to gas. It was expected to stop consuming coal in September 2023, but this may have been brought forward marginally (unconfirmed).

West Burton coal power station closed at the end of March 2023 delayed by the UK Government from September 2022.

Coal phase-out in the UK is expected by October 2024. Given that coal consumption in power stations is very low, with periods of no consumption, in the summer, the last generation could be April 2024.

In 2022, coal production fell by 39% to a record low of 0.6 million tonnes, with opencast coal mining producing more than underground mines.[1]

The Scottish Government announced a de-facto ban on coal mining in October 2022, in protest against the expected approval of the Whitehaven coking coal mine. We anticipate this stopped a deep coal mine application by Australian company New Age Explorations at Lochinvar in the Scottish borders. The company hoped to produce coking coal via underground mining until 2044.

Campaigns against proposed underground mines

Aberpergwm Colliery (Energybuild Ltd) in Neath Port Talbot had planning permission for a 42 million tonne extension to its underground (anthracite) coal mine approved in 2018. The Coal Authority issued the coal company a license to extract this coal in January 2022. Coal Action Network are taking legal action against the Welsh Government for failing to stop the mine extension being licenced.

Woodhouse Colliery proposed by West Cumbria Mining Ltd had its proposal for a new 1.78 million tonne per year underground coking coal mine off Whitehaven approved by the Secretary of State in December 2022. The planning approval is subject to 2 legal challenges which are expected to be heard by the High Court in early 2024.

There are now no legally operating opencast coal mines in the UK.

Glan Lash opencast coal mine, Carmarthenshire (South Wales), had an extension application rejected in September 2023.

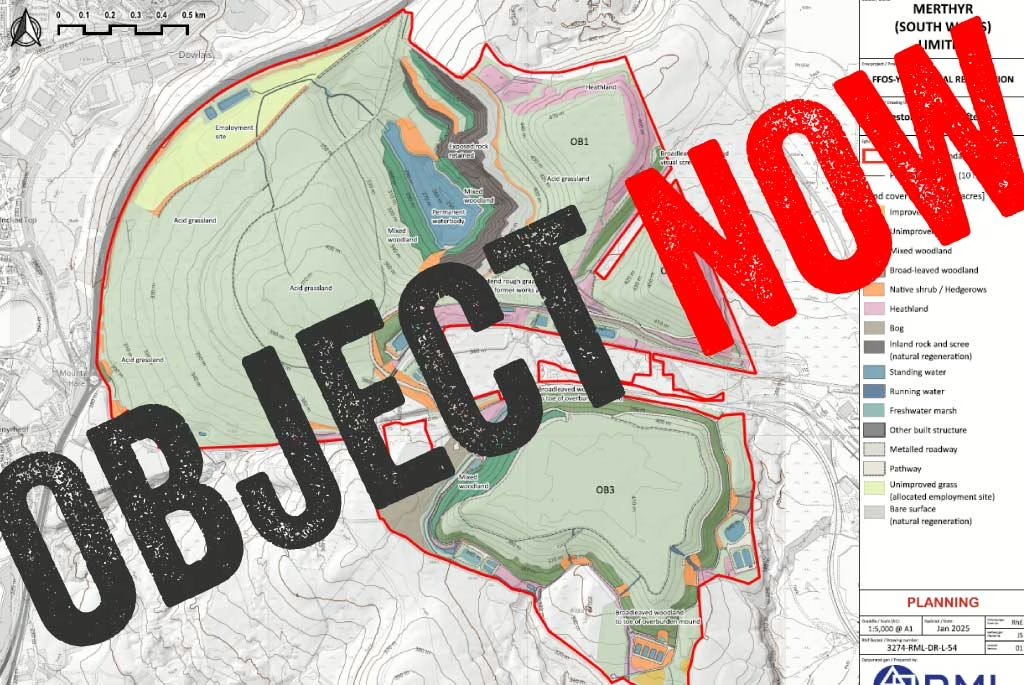

In September 2022, Ffos-y-fran opencast coal mine in Merthyr Tydfil, was due to close after 15 years of operation. However, the mine has continued to operate with little action from the local council or Welsh Government. It is now expected to close at the end of Nove mber 2023, with no meaningful restoration of the land expected, as the company did not set aside the money to fulfil its contractual obligations in this regard. The guarantee bond of £15 million to be used in case this happens is far short of the estimated £120 million needed for restoration as per the original plan. The coal mining was originally approved by Welsh Government in 2005 as a way to restore a brownfield site at no cost to the public purse, an outcome that now appears remote.

mber 2023, with no meaningful restoration of the land expected, as the company did not set aside the money to fulfil its contractual obligations in this regard. The guarantee bond of £15 million to be used in case this happens is far short of the estimated £120 million needed for restoration as per the original plan. The coal mining was originally approved by Welsh Government in 2005 as a way to restore a brownfield site at no cost to the public purse, an outcome that now appears remote.

Hartington opencast coal mine, Derbyshire closed at the end of Spring 2023.[2]

Coal imports rose 38% in comparison with 2021 to 6.4 million tonnes in 2022 as power stations rebuilt stocks after the UK Government payments over winter. The import quantity had been decreasing prior to this government intervention.

In 2022, the USA was the largest exporter of coal to the UK, supplying 39%. This was followed by the Russia with 16%. Russia’s proportion of total coal imports had fallen from being the largest supplier at 43% in 2021.

Coal from the USA was fairly evenly split between coking coal for steelworks and thermal coal for power stations.

Coal from Russia was largely for power stations.

Australia provided 12% of imported coal. 57% of which was for power stations, the rest for steelworks. 10% of coal came from South Africa, which was entirely for power stations. Colombia supplied 7% of imported coal all to power stations.

The European Union supplied 9% of all coal to the UK. This coal is unlikely to have been mined in the EU, it has most likely lost its identity as coal enters and leaves the main coal ports in Europe. Other countries made up the remainder of the imported coal.

There are 4 major UK steel producers, 2 of which are using coking coal and produce much higher emissions than the two which recycle scrap steel.

Tata Steel

Port Talbot steel works, in Neath Port Talbot, Wales, is the second biggest UK single site emitter of carbon dioxide.[3] The plant currently uses coking coal to make steel in blast furnaces. In 2022, Tata Steel said the plant had to decarbonise or close. In September 2023, Tata Steel accepted £500 million from the UK Government to transition to electric arc furnace, but job losses are expected.

British Steel

Currently, British Steel’s Scunthorpe plant can use a maximum of 25% to 30% recycled content using Basic Oxygen steelmaking. It currently uses coking coal but is also looking to secure governmental subsidies to build a new electric arc furnace to replace a blast furnace in efforts to decarbonise.

Liberty

Liberty Steel, which has sites in Newport and in Tredegar, has said it aims to become a carbon-neutral steel producer by 2030. The site currently uses Electric Arc Furnaces and recycles scrap metal so does not use coking coal.

Celsa

Celsa’s Cardiff steelworks uses 100% recycled scrap steel in its products and so does not need coking coal.

For more details see our report Coal in Steel.

[1] compiled from Coal Authority, "Production and Manpower Statistics" for 2022

[2] Gov.uk "Coal mining production and manpower returns received by the Coal Authority April to June 2023." (July 2023)

[3] Ember, Coal Free Kingdom (13th November 2019) and Drax Group, Enabling a zero carbon, lower cost energy future page 39 (2019)

Queries and media contact: info @ coalaction . org .uk (without spaces)

References

[1] compiled from Coal Authority, "Production and Manpower Statistics" for 2022

[2] Gov.uk "Coal mining production and manpower returns received by the Coal Authority April to June 2023." (July 2023)

[3] Ember, Coal Free Kingdom (13th November 2019) and Drax Group, Enabling a zero carbon, lower cost energy future page 39 (2019)

Queries and media contact: info @ coalaction . org .uk (without spaces)

16 years of opencast coal mining in Ffos-y-fran has generated colossal overburden mounds, also known as slag heaps or coal tips. There are three coal tips, with the third being the largest, and cumulatively accounting for 37 million cubic metres of colliery spoil, rocks, and soil…

We were invited for the second time to give oral evidence to the Climate Change, Environment, and Infrastructure Committee of the Welsh Parliament (Senedd) on 05th February 2025. We shared the panel with Haf, Director of FOE Cymru, to provide our opinion on the weaknesses, strengths…

Merthyr (South Wales) Ltd mined for over a year illegally after planning permission for the Ffos-y-fran opencast coal mine ended in September 2022. During that year, it made record-breaking profits due to sanctions on Russia and other factors driving up the price of coal. But rather than using some of the profits from that ill-gotten coal…

MSW claims “It was established that there are insufficient funds available to achieve the 2015 restoration strategy and therefore an alternative scheme is required.” (EIA Scoping Report, July 2024)… To our knowledge, there has been no evidence submitted by MSW that it cannot fund the full restoration it is contracted to undertake…

The UK Government launched a consultation on a limited review of the National Planning Policy Framework (NPPF) for 8 weeks from 30 July to 24 September 2024. The NPPF is an influential document that shapes planning decisions and priorities across England. It is periodically updated by the Government, following a public consultation…

Bryn Bach Coal Ltd attempts to present the anthracite coal it wishes to extract from an expansion of Glan Lash as a unique and scarce commodity that is needed for water filtration, bricks, and graphite, and would therefore be too valuable to burn. Yet, visiting Energybuild Ltd’s…

Over the past year, we’ve secured some massive victories. By taking part in our digital actions, supporters sent over 26,000 messages to the UK Government, MPs, Welsh Senedd members, Councillors, and companies to help consign coal to the history books in the UK…

The Disused Mine and Quarry Tips (Wales) Bill (‘the Bill’) was prompted by a series of coal tip landslides that occurred in Wales following storms’ Ciara and Dennis in 2020, including a major landslide of a disused coal tip in Tylorstown…

As B Labs doesn’t seem bothered was the public says, we asked supporters to contact other B Corps – who are effectively B Labs customers. Almost 20,000 emails were sent to over 60 B Corp status companies, asking them to take a stand with us…