This week, facing mounting pressure from campaigners, Lloyd’s of London syndicate, Probitas1492, ruled out providing insurance for Adani’s Carmichael coal mine and its related infrastructure. Probitas was known to insure the mine’s transport system, but also admitted that the mine itself had been insured through the Lloyd’s of London marketplace.

Ash Bathia, Chief Executive Officer of Probitas Managing Agency wrote to Money Rebellion, stating: “I can confirm that Probitas1492 ceased to provide insurance for the Adani Coal Mine at the end of last year, and will also not provide any insurance support in the future for any ancillary or associated activities, including the trainline, once the existing policies expire in the next quarter.”

Various environmental groups have targeted Probitas since February, when an industry tip-off revealed that they were underwriting Adani’s train line and haulage operation. Last week, Money Rebellion activists staged a ‘die-in’ protest at Probitas’s London office. This followed disruption to Lloyd’s AGM in May, and a delivery of giant Valentine’s Day cards asking Probitas to exit the mine, including from the head man of Waddananggu tribe.

Claude Fourcory, Money Rebellion, said: “This is a massive win for the movement. Deadly fossil fuel projects like Adani’s Carmichael mine can’t be allowed to continue. Insurers at Lloyd’s of London are only going to see bigger and bigger protests, as more people understand their involvement in enabling climate breakdown.”

Gurridyula Gaba Wunggu, Wangan and Jagalingou Cultural Custodian, said: “Probitas1492 has made the right decision – this shows the strength and determination of everyone who played their part in forcing their hand. This is also a message to all other Adani financiers and insurers – we are coming for you too and we will not stop until you pull out from Adani. This has been the homeland of our people for millennia. Any insurer or financier still backing Adani is complicit in the destruction of Wangan and Jagalingou homelands and the ethnic cleansing of our culture and people. Don’t underestimate our determination. We plan to be here until Adani is forced to abandon this project, so we can watch them pack up and leave our homelands for good.”

Set to be the largest coal mine in Australia, Carmichael has been called a ‘carbon bomb.’ [1] The Queensland project would produce enough coal over its lifetime to emit 4.6 billion tonnes of CO2, equivalent to over ten years of the UK’s annual emissions. The Australian coal is burned in Adani’s Godda power station in Jharkhand, India, which is already mired in human rights abuses including forced displacement, and two workers have been killed on site.

Probitas1492 now joins 45 of the world’s biggest insurers who have distanced themselves from the mine, including five that had previously provided Adani with coverage: Brit, Apollo, Ascot, Aspen, Tokio Marine and Kiln. 28 of these insurers manage syndicates at the Lloyd’s marketplace.

Marsh McLennan, the world’s largest broker, stopped arranging insurance for Adani last year due to pressure over the project’s environmental abuses.

The Adani Carmichael mine has received widespread condemnation from climate scientists and activists, both locally and internationally, for its impact on water usage and carbon emissions. The mine’s Abbot Point coal port is located in the Great Barrier Reef World Heritage Area, and campaigners estimate the mine would bring 500 coal ships through it every year.

Meanwhile, experts fear that Adani’s vast drainage of nearby groundwater may have already “locked in” irreversible damage to local, ancient wetlands known as the Doongmabulla Springs.

The springs are sacred to the land’s traditional owners, the Wangan and Jagalingou people, who have never given their free, prior and informed consent to the mine. Indigenous leaders have resisted the project since its inception.

Pablo Brait, Campaigner at Market Forces in Australia said: “The Carmichael coal mine is one of the most controversial projects in Australia’s history. It will drain the region of billions of liters of water per year, putting agriculture at risk. It is increasing industrialisation in the already distressed Great Barrier Reef, and it will fuel worsening floods, heatwaves and bushfires. The Carmichael operations are paving the way for more climate-wrecking coal mines in the region, and its dirty coal is being used by Adani to expand its fossil fuel burning activities in India.”

More trouble for Adani

Adani began exporting small amounts of coal from Carmichael in 2022 – 8 years behind schedule – and has been rocked by difficulties throughout.

Earlier this year, Lockton, another top-10 global broker, entered talks with Adani, before deciding in July not to proceed after pressure from campaign groups and staff.

In total, 113 major companies in the banking, insurance, rail freight and engineering sectors have now ruled out support for Adani Carmichael, or the Adani Group entirely. This includes banking giants BNY Mellon and China’s ICBC.

Controversy for Lloyd’s

Probitas1492’s involvement with Adani is understood by campaigners to have caused controversy within the Lloyd’s of London marketplace. Lloyd’s policy, as of 1 January 2022, asks syndicates not to take on new thermal coal risks. Lloyd’s has been criticised, however, for failing to implement this.

Andrew Taylor, Coal Action Network said: “The fact that the Adani coal mine infrastructure was still being insured through Lloyd’s points to an abject failure of its ESG policy. It shouldn’t take thousands of people from across the world to pressure Lloyd’s managing agents to cut ties with new fossil fuel projects. These companies need to act themselves and adopt policies and behaviour that reflect the existential threat climate change poses.”

Due to the pooled nature of coverage written at Lloyd’s, other syndicates may still be involved in Adani Carmichael. Lloyd’s managing agents yet to comment publicly on their involvement include: Barbican, Hamilton, Markel, Renaissance Re, SA Meacock and Starr.

Probitas1492’s withdrawal follows comments from Dominic Hoare, Chief Underwriting Officer at Lloyd’s Munich Re Syndicate and a senior industry figure, on the reputational risk of insuring fossil fuels: “Reputation is now key and reputation affects your share price…From our point of view, pressure to cease underwriting is very effective. Insurance is an incredible tool for enacting change.”

Lloyd’s of London is the world’s oldest and largest global insurance market. Developed in the 1600s, it drew its initial wealth from insuring the slave trade. It remains the world’s largest insurer of fossil fuels.

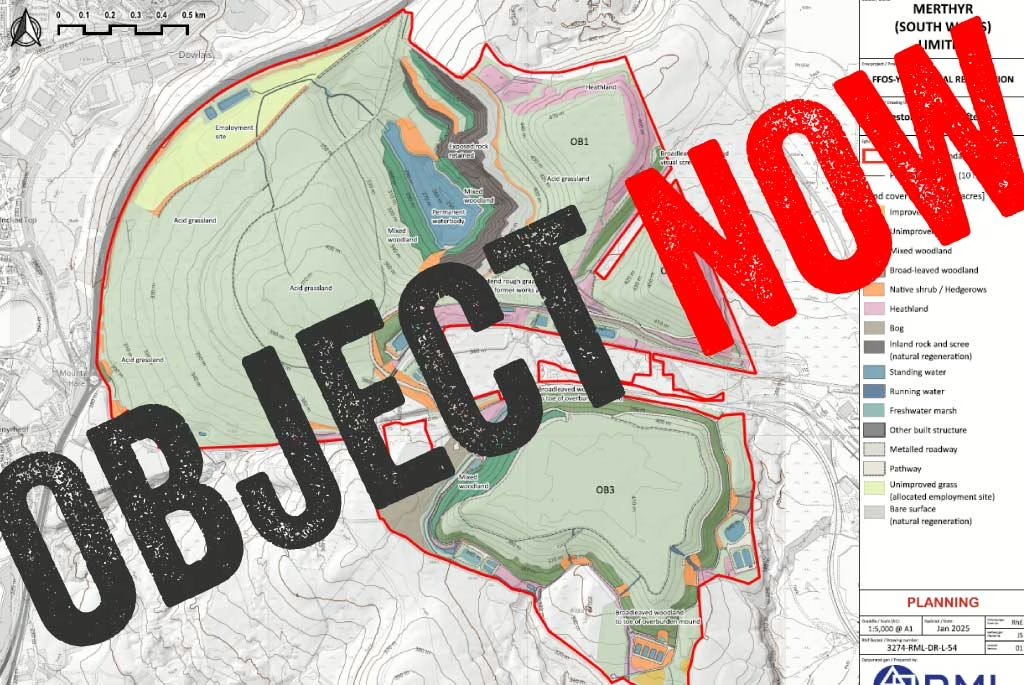

16 years of opencast coal mining in Ffos-y-fran has generated colossal overburden mounds, also known as slag heaps or coal tips. There are three coal tips, with the third being the largest, and cumulatively accounting for 37 million cubic metres of colliery spoil, rocks, and soil…

We were invited for the second time to give oral evidence to the Climate Change, Environment, and Infrastructure Committee of the Welsh Parliament (Senedd) on 05th February 2025. We shared the panel with Haf, Director of FOE Cymru, to provide our opinion on the weaknesses, strengths…

Merthyr (South Wales) Ltd mined for over a year illegally after planning permission for the Ffos-y-fran opencast coal mine ended in September 2022. During that year, it made record-breaking profits due to sanctions on Russia and other factors driving up the price of coal. But rather than using some of the profits from that ill-gotten coal…

MSW claims “It was established that there are insufficient funds available to achieve the 2015 restoration strategy and therefore an alternative scheme is required.” (EIA Scoping Report, July 2024)… To our knowledge, there has been no evidence submitted by MSW that it cannot fund the full restoration it is contracted to undertake…

The UK Government launched a consultation on a limited review of the National Planning Policy Framework (NPPF) for 8 weeks from 30 July to 24 September 2024. The NPPF is an influential document that shapes planning decisions and priorities across England. It is periodically updated by the Government, following a public consultation…

Bryn Bach Coal Ltd attempts to present the anthracite coal it wishes to extract from an expansion of Glan Lash as a unique and scarce commodity that is needed for water filtration, bricks, and graphite, and would therefore be too valuable to burn. Yet, visiting Energybuild Ltd’s…

Over the past year, we’ve secured some massive victories. By taking part in our digital actions, supporters sent over 26,000 messages to the UK Government, MPs, Welsh Senedd members, Councillors, and companies to help consign coal to the history books in the UK…

The Disused Mine and Quarry Tips (Wales) Bill (‘the Bill’) was prompted by a series of coal tip landslides that occurred in Wales following storms’ Ciara and Dennis in 2020, including a major landslide of a disused coal tip in Tylorstown…

As B Labs doesn’t seem bothered was the public says, we asked supporters to contact other B Corps – who are effectively B Labs customers. Almost 20,000 emails were sent to over 60 B Corp status companies, asking them to take a stand with us…