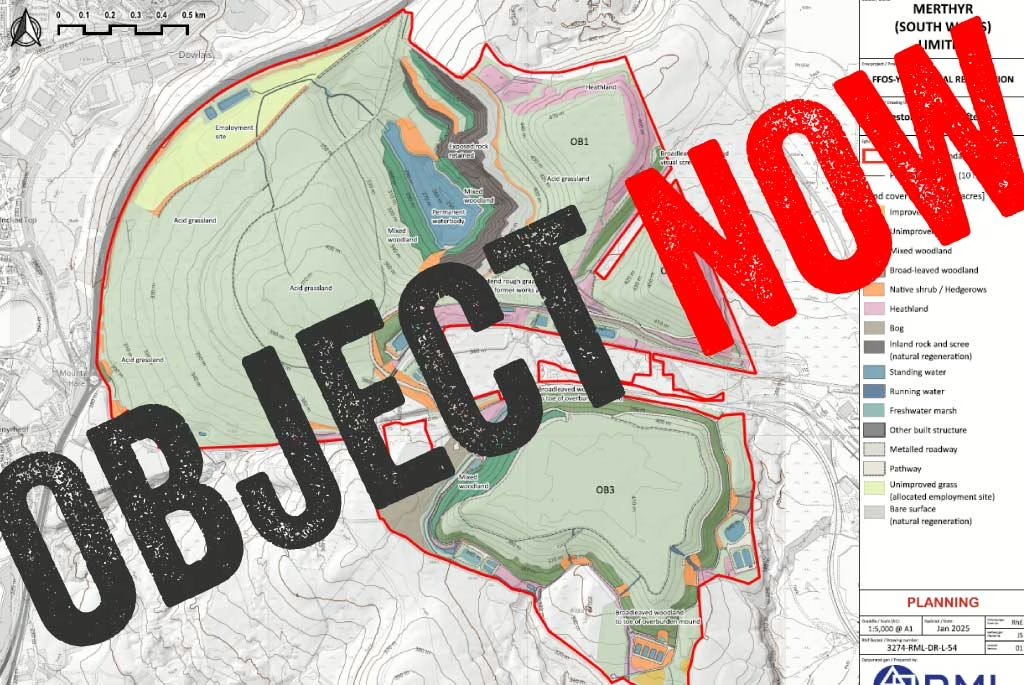

Ffos-y-fran (pronounced in English as Foss-uh-vran and also known as the 'Ffos-y-Fran Land Reclamation Scheme') is a large opencast coal mine in Merthyr Tydfil, South Wales, mining primarily thermal coal. Mining company Merthyr Ltd (previously, Miller Argent) was awarded planning permission in February 2005 on appeal and began opencast coal mining. Planning permission for the opencast coal mining came to an end on 06th September 2022 (confirmed by Merthyr Tydfil County Borough Council to Coal Action Network under a Freedom of Information request).

The two planning conditions that Merthyr Ltd are pressuring the Council to throw out are:

Merthyr Ltd want to delay its restoration responsibility and extend mining its dirty coal from the Ffos-y-fran opencast initially by 9 months (06 June 2023), but then by a further 3 years. The 9 month extension is to give the coal operator enough time to mine a further 240,000 tonnes of coal and submit an application for a 3 year extension but during this time, it’ll be mining as much coal as it can. See all the application documents at P/22/0237.

So, how does Merthyr Ltd seek to justify breaking its promise to the Council and local communities to restore and end opencast coal mining?

In a personally signed letter to the Council, Merthyr Ltd’s Director, David Lewis, claims production was reduced due to lockdowns so not all the coal could be mined in the void that was expected to be by the deadline of the 06 September 2022, so a time extension should be awarded to “ensure the full reserve can be realised”.

There are two issues with the justification attempted in Lewis’s letter:

Via repeated Freedom of Information Requests, Coal Action Network eventually succeeded in forcing the Council admit only £15 million had been deposited by Merthyr Ltd into the escrow account for restoration. In 2018, restoration was estimated to cost £62 million, meaning there is roughly a £47 million shortfall (depending on how much of the site has been restored alongside coal mining since 2018). This is shortfall is highlighted by Merthyr Ltd in its Planning Statement for the time extension: “As the Council is fully aware, there are insufficient funds within the Escrow and restoration fund to allow for the full and successful implementation of the current restoration strategy for the site.”

Merthyr Ltd’s solution is “that the additional time to finish extraction and restoration will enable a more sustainable and modernised restoration scheme”. Although Merthyr Ltd promised to fund and carry out a restoration strategy as a condition to it gaining planning permission, the company now uses its failure to fulfil this condition as a reason to let it mine more coal. And by “modernised”, Merthyr Ltd almost certainly mean cheaper restoration scheme.

Merthyr Ltd transferred most the of the land ownership to Geraint Morgan Legacy Limited of which David Lewis is the sole Director. If the Council attempts to recover the £47 million shortfall for restoration, and Merthyr Ltd cannot pay, responsibility may lie with the landowner, which appears from its Companies House records to only have £2 million in the bank. Merthyr Ltd may reap the profits from years of mining, and the Council could be face bankruptcy to pay the remaining shortfall for restoration.

Similar situations have been seen with other mining companies (most notoriously by Celtic Energy) holding Councils to ransom for permitting more coal mining by threatening to fold or transferring the liability to shell companies, knowing Councils can’t afford to fund the massive costs involved in restoring ex-coal mining sites.

Merthyr Ltd have known for years that planning permission at Ffos-y-fran would expire on 06 September 2022, yet attempts to leverage the fact that it has seemingly failed to support its workers to reskill or find alternative employment as a reason to extend the planning permission: “…it will ensure that current employees have a further 9 months to weather the cost of living crisis and look for alternative means of employment” (Planning Statement).

Incredulously, Merthyr Ltd even goes beyond this neglect towards its workers, to use its own lack of business strategy as it approached the known end of planning permission as a rationale for permitting the initial 9 month extension to allow “…the operators of the mine to look at other investment possibilities.”

Merthyr Ltd’s Planning Statement attempts the justification commonly used be coal mining companies in the UK: “The transport emissions for each tonne of UK coal delivered to Port Talbot are typically five times lower than coal imported from abroad” and therefore, less CO2 is emitted overall if coal is mined and used in the UK. This argument relies on the idea that more coal mining in the UK would displace the same amount of coal being mined in another country, and the coal mined in the UK would be used in the UK.

Coal-laden HGV leaving the Ffos-y-fran opencast coal mine on 13/09/2022

Coal operators are notorious for making lofty claims about the unrivalled quality of coal they would mine—this is to circumvent the presumption against new coal extraction in planning decisions, hoping to fit into the loophole made for exceptional need and economic value.

Merthyr Ltd has rebranded its thermal coal as “dry steam coal”, a term that doesn’t seem to be widely used by anyone except Merthyr Ltd and its trade customers. In reality, this is just thermal coal, and used to be primarily sold to RWE’s Aberthaw coal-fired power station. However, Aberthaw had to stop burning coal from Ffos-y-fran to generate electricity because the European Court of Justice ruled the toxic nitrogen oxides it emitted were too high.

With the loss of this customer, Merthyr Ltd invested £10 million in machinery to refine some of its lower grade coal to ‘metallurgical’ coal that could be used in steelworks in 2015.

Merthyr Ltd has clearly been studying other coal mine applications in the planning system, and likewise in its Planning Statement emphasises Port Talbot Steelworks’ reliance on coal, claiming its thermal coal is needed in the vaguely worded “steel manufacturing process”.

Like most coal operators, Merthyr Ltd (and former coal operators) like to change the rules along the way. The original coal operator agreed to all the conditions attached to the original planning permission in 2005, but in 2008, the coal operator wanted to rip up condition 37 requiring col to leave the site by freight train. The coal operator applied for a 'S73' change to use HGVs to transport 100,000 tonnes of coal each year by road, rather than rail. The company pragmatically reduced this to 50,000 tonnes but HGVs loaded with coal on the roads is dirty and dangerous, so the Council rejected the attempt to change this condition. The company didn’t accept this, and won the right to change this condition on appeal in May 2011 (APP/U6925/A/10/2129921)

Merthyr Ltd want to change the rules again with this 'S73' application for a time extension to mine more coal and delay the promised restoration. Each time the coal operators change the rules, it’s inevitably the local communities living in Merthyr Tydfil that pay the price. Enough is enough.

This nature was photographed around 50 metres from the edge of the Glan Lash opencast coal mine in Ammanford, South Wales. It shows the thriving ecosystems surrounding the Glan Lash opencast coal mine which has remained dormant since 2019…

In February, CAN gave oral testimony to the Climate Change, Energy, and Infrastructure Committee (CCEIC) on the Disused Mine and Quarry Tips (Wales) Bill…

Coal Action Network was invited to attend Westminster where we gave evidence to the Welsh Affairs Committee in their inquiry about the environmental and economic legacy of Wales’ industrial past, alongside Friends of the Earth Cymru. This inquiry was opened in…

16 years of opencast coal mining in Ffos-y-fran has generated colossal overburden mounds, also known as slag heaps or coal tips. There are three coal tips, with the third being the largest, and cumulatively accounting for 37 million cubic metres of colliery spoil, rocks, and soil…

We were invited for the second time to give oral evidence to the Climate Change, Environment, and Infrastructure Committee of the Welsh Parliament (Senedd) on 05th February 2025. We shared the panel with Haf, Director of FOE Cymru, to provide our opinion on the weaknesses, strengths…

Merthyr (South Wales) Ltd mined for over a year illegally after planning permission for the Ffos-y-fran opencast coal mine ended in September 2022. During that year, it made record-breaking profits due to sanctions on Russia and other factors driving up the price of coal. But rather than using some of the profits from that ill-gotten coal…

MSW claims “It was established that there are insufficient funds available to achieve the 2015 restoration strategy and therefore an alternative scheme is required.” (EIA Scoping Report, July 2024)… To our knowledge, there has been no evidence submitted by MSW that it cannot fund the full restoration it is contracted to undertake…

The UK Government launched a consultation on a limited review of the National Planning Policy Framework (NPPF) for 8 weeks from 30 July to 24 September 2024. The NPPF is an influential document that shapes planning decisions and priorities across England. It is periodically updated by the Government, following a public consultation…

Bryn Bach Coal Ltd attempts to present the anthracite coal it wishes to extract from an expansion of Glan Lash as a unique and scarce commodity that is needed for water filtration, bricks, and graphite, and would therefore be too valuable to burn. Yet, visiting Energybuild Ltd’s…

Has the local council actually approved the initial time extension.?

Not yet. We’re trying to make sure they don’t.

Hi, I really hope it is declined it is a Dirty, unhealthy business, these people are greedy, it should not be allowed they had their time, and now it is up.