Reposted from Insure our Future

Lloyd’s of London published its 2021 Environmental, Social and Governance (ESG) Report two days ahead of its Annual General Meeting on May 19.

Lloyd’s second ESG report is a document almost completely lacking in substance which does more to obscure the climate destroying actions of its members than to shed light on how it intends to reach its often stated net-zero by 2050 ambition. It has almost no information on concrete climate action and raises many serious questions about Lloyd’s.

Most notably, Lloyd’s second ESG report says nothing about the outcomes of the climate commitments it made in its first ESG report released at the end of 2020. Previously, Lloyd’s stated it was asking its managing agents to not provide any new cover for coal-fired plants, coal mines, oil sands and Arctic energy exploration from 1st January 2022. Yet, its current report fails to report on whether or not its members are fulfilling this commitment.

Whilst Lloyd’s ESG report doesn’t tell us, we already know from other sources that not all members of Lloyd’s market have stopped providing new insurance cover for new coal projects.

For example, a recent public report by London based insurance broker Alesco, noted that while many Lloyd’s members have adopted the policy, others continue to accept new coal business.

Why has Lloyd’s, which knows these facts, not been open or honest about them in this report? Which Lloyd’s members are ignoring Lloyd’s stated ambitions? What action is Lloyd’s taking to bring those members into line? What value do Lloyd’s stated climate ambitions and targets have when they are so plainly ignored by some of its members with no consequence?

Instead of addressing these obvious questions Lloyd’s is trying to cover up its failure to deliver on its climate commitments. In other words, Lloyd’s 2021 ESG report is greenwash.

Whilst avoiding mention of its failure to have all members exclude the very worst fossil fuel projects, this report goes much further in the wrong direction. Lloyd’s doubles-down on requiring its members to continue to insure what it terms the “harder-to-abate sectors”, by which it presumably means it plans to adopt no restrictions on new oil and gas exploration. Lloyd’s completely ignores the IPCC, the IEA and others which make clear that no new oil and gas projects are compatible with staying within 1.5C global warming, and that existing production needs to be phased down.

One example of concrete climate action Lloyd’s trumpets is appointing its first Sustainability Director. The ESG report fails to mention that Lloyd’s management gave the role to one of its Senior Public Relations Officers, who had no previous sustainability-related experience. Is that an example of bringing in a great communicator to an important new priority role? Or a classic example of treating ESG as more of a public relations exercise than a substantive issue? What is clear is that the quantity and quality of largely substance free public relations materials from Lloyd’s about sustainability has increased significantly in the last 12 months.

Lloyd’s Council Chair Bruce Carnegie-Brown and its CEO John Neal sign off the report saying:

“We hope this report equips you with a helpful and comprehensive summary of our ESG activity – and we look forward to working with you to build the braver world it imagines.”

In a climate crisis that presents an existential threat to life on earth, Lloyd’s is stuck in its PR bubble talking about sharing risks to create a braver world, when in reality its members provide the insurance cover for, and invest in, climate and human-rights destroying fossil fuel projects and companies.

Lloyd’s new ESG report exemplifies many of the worst aspects of corporate greenwashing. Saying it is committed to net-zero by 2050, but not having detailed targets and not enforcing the targets it does express is not a climate science aligned policy, it is greenwash. Lloyd’s Council, led by its Chairman Bruce Carnegie-Brown, needs to start taking genuine climate action by ensuring Lloyd’s members stop insuring and investing in new fossil fuels and phase out existing investments and insurance in-line with climate science. Nothing less will do.

Finally, there are a few words in the report that I do agree with:

Rebekah Clement Lloyd’s new Sustainability Director: “The work is nowhere near done…”

David Sansom Lloyd’s Chief Risk officer: “We have much more to do…”

Alesco Energy Update 2022. Page 21: “1 January 2022 saw the introduction of the new Lloyd’s directive as regards to coal; with the initially proposed stance being that no new coal business was to be underwritten from that date. However, in light of subsequent discussions between various parties, there has been a subtle change of emphasis with each syndicate now having a more individual responsibility towards their attitude to the new coal business. Many have chosen to remain with the existing policy of not putting any new coal accounts onto their books; but others have adopted a policy of accepting new business where the client can demonstrate a clear approach to working towards an orderly transition to renewable energy”.

As part of our Politics Unspun series we are unpacking politicians’ public comments on coal to challenge any misleading or incorrect messages. Todays’ focus is on comments made during a Westminster Hall debate in December 2025 about the oil refining sector. During the debate, Lee Anderson MP made some statements about coal…

The Government is reforming planning policy in England and thanks to thousands of our supporters asking for an end to coal extraction in the last consultation in 2024, they are now recommending that planners “should not identify new sites or extensions to existing sites for peat or coal extraction”…

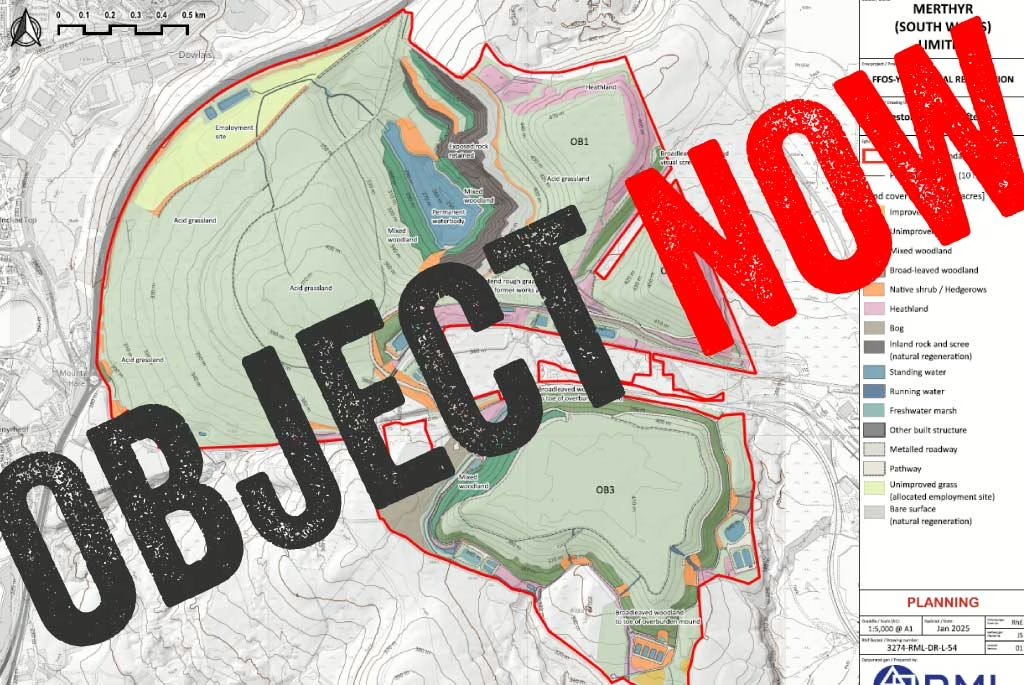

Merthyr (South Wales) Ltd mined for over a year illegally after planning permission for the Ffos-y-fran opencast coal mine ended in September 2022. During that year, it made record-breaking profits due to sanctions on Russia and other factors driving up the price of coal. But rather than using some of the profits from that ill-gotten coal…

In November 2024, the new UK Government announced its intention to legislate a ban of new coal mining licences – which we welcomed. Over a year later, the legislation is yet to be introduced, and the Government is not planning to include all types of extraction…

The UK steel and cement sectors (and to a lesser extent, bricks) are the largest users of coal following the closing down of the UK’s last coal-fired power station in September 2024. Check out our coal dashboard for our most recent coal stats including an industry break-down. We support the UK Government’s commitment to ban…

The steel industry produces 9-11% of the annual CO2 emitted globally, contributing significantly to climate change. In 2024, on average, every tonne of steel produced led to the emission of 2.2 tonnes of CO2e (scope 1, 2, and 3). Globally in 2024, 1,886 million tonnes (Mt) of steel were produced, emitting…

Last month we worked with Members of Parliament from various parties on a Westminster Hall debate about coal tip safety and the prohibition of new coal extraction licences. The debate happened 59 years and one day after the Aberfan tragedy which killed 116 children and 28 adults…

Successful, at-scale, examples already exist of cement works burning 100% fuel alternatives to traditional fossil fuels, including pilot projects using combinations of hydrogen and biomass (UK) and hydrogen and electricity (Sweden). Yet, innovations such as use of hydrogen and kiln electrification are…

Within the borders of the Senedd Caerphilly constituency is the proposed Bedwas coal tips re-mining project. In the lead up to the Senedd by-election, Coal Action Network has carried out a survey of the by-election candidates asking for their views about the re-mining of the Bedwas and other…