The natural world of Glan Lash

April 18th 2025

This nature was photographed around 50 metres from the edge of the Glan Lash opencast coal mine in Ammanford, South Wales. It shows the thriving ecosystems surrounding the Glan Lash opencast coal mine which has remained dormant since 2019…

Committee takes forward CAN’s key recommendations

April 15th 2025

In February, CAN gave oral testimony to the Climate Change, Energy, and Infrastructure Committee (CCEIC) on the Disused Mine and Quarry Tips (Wales) Bill…

Westminster: our evidence on Wales’ coal legacy

April 7th 2025

Coal Action Network was invited to attend Westminster where we gave evidence to the Welsh Affairs Committee in their inquiry about the environmental and economic legacy of Wales’ industrial past, alongside Friends of the Earth Cymru. This inquiry was opened in…

Lethal landscape: cuts to Ffos-y-fran mine restoration puts community at risk

March 25th 2025

16 years of opencast coal mining in Ffos-y-fran has generated colossal overburden mounds, also known as slag heaps or coal tips. There are three coal tips, with the third being the largest, and cumulatively accounting for 37 million cubic metres of colliery spoil, rocks, and soil…

We’re back in the Senedd giving oral evidence

March 24th 2025

We were invited for the second time to give oral evidence to the Climate Change, Environment, and Infrastructure Committee of the Welsh Parliament (Senedd) on 05th February 2025. We shared the panel with Haf, Director of FOE Cymru, to provide our opinion on the weaknesses, strengths…

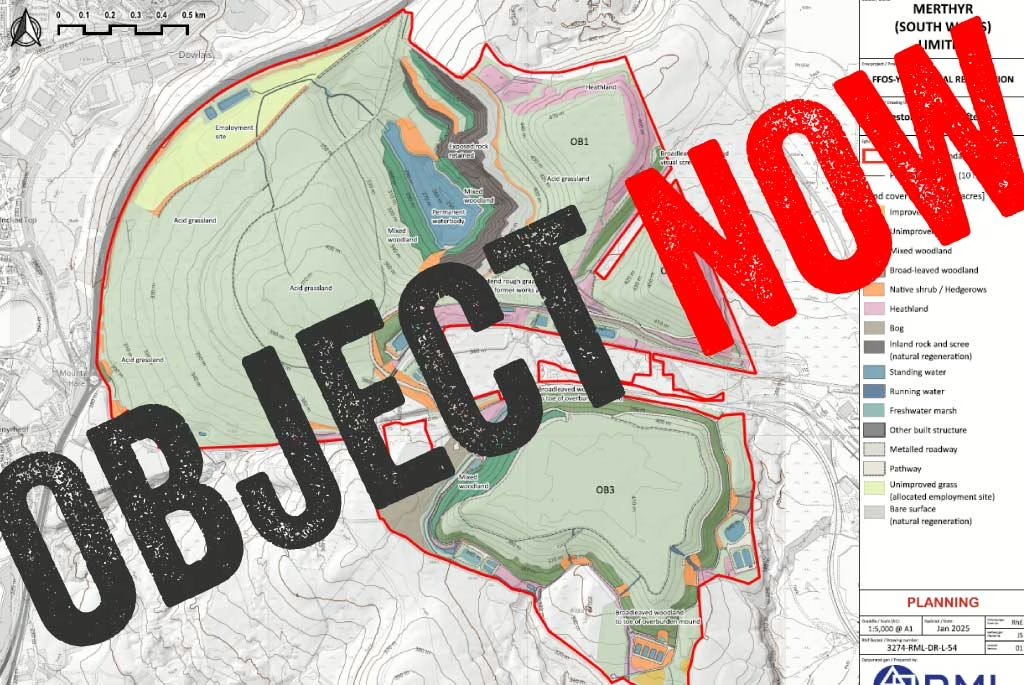

Demand nature be restored to Ffos-y-fran opencast site

February 28th 2025

Merthyr (South Wales) Ltd mined for over a year illegally after planning permission for the Ffos-y-fran opencast coal mine ended in September 2022. During that year, it made record-breaking profits due to sanctions on Russia and other factors driving up the price of coal. But rather than using some of the profits from that ill-gotten coal…

We investigate mining company’s ‘missing’ millions

February 6th 2025

MSW claims “It was established that there are insufficient funds available to achieve the 2015 restoration strategy and therefore an alternative scheme is required.” (EIA Scoping Report, July 2024)… To our knowledge, there has been no evidence submitted by MSW that it cannot fund the full restoration it is contracted to undertake…

UK Government: is the left hand speaking to the right hand?

January 8th 2025

The UK Government launched a consultation on a limited review of the National Planning Policy Framework (NPPF) for 8 weeks from 30 July to 24 September 2024. The NPPF is an influential document that shapes planning decisions and priorities across England. It is periodically updated by the Government, following a public consultation…

We expose company’s misleading claims

January 6th 2025

Bryn Bach Coal Ltd attempts to present the anthracite coal it wishes to extract from an expansion of Glan Lash as a unique and scarce commodity that is needed for water filtration, bricks, and graphite, and would therefore be too valuable to burn. Yet, visiting Energybuild Ltd’s…