Meeting reveals Neal’s failure to understand the need to stop insuring fossil fuel expansion

On February 16, Insure Our Future network members challenged John Neal, CEO of Lloyd’s of London, on the insurer’s fossil fuel policies and actions in a long awaited, but ultimately very disappointing, on-the-record meeting at Lloyd’s Lime Street headquarters.

The meeting between Neal, Lindsay Keenan, European Coordinator of Insure Our Future, and Mia Watanabe, UK Campaigner at Market Forces, revealed major problems with how Lloyd’s, and in particular its CEO, is addressing the climate crisis. The meeting started with Neal accepting a letter with 137,400 signatures on behalf of SumOfUs, an Insure Our Future network member. The letter demanded Lloyd’s stop supporting new and expansionary coal, oil and gas projects, including the East African Crude Oil Pipeline, Trans Mountain pipeline, Adani Carmichael coal mine, and oil drilling by the Bahamas Petroleum Company.

In stark contrast to statements made by Lloyd’s Council Chairman, Bruce Carnegie Brown, and what is clearly written in Lloyd’s December 2020 ESG report, Neal stated that in his view Lloyd’s ESG policy was nothing more than a “‘provocative discussion document”.

Revealingly, Neal claimed that, following the publication of the report, he had been contacted and lobbied by regulators, corporations, and state and national officials from around the world who said they were against the ESG policy and concerned about its ambitions. He confirmed that Lloyd’s had subsequently informed its members the ESG commitments were non-mandatory guidelines.

Despite lending a sympathetic ear to industry stakeholders, Neal was unequivocal in stating that he did not see it as his role to meet with representatives of communities impacted by the fossil fuel projects that Lloyd’s insures or invests in.

While professing to respect climate science and the International Energy Agency’s (IEA) 2021 report, Neal appeared to not understand nor accept the report’s key finding that there are no new coal mines or oil and gas fields approved for development in a Net Zero by 2050 pathway. Under Neal, Lloyd’s has no plan to align its policies with the IEA findings.

“It is a serious problem that John Neal has not been well enough briefed, or is just personally sceptical, about climate science and the findings of the International Energy Agency. An ESG policy touted by Carnegie-Brown as a ‘plan for becoming a truly sustainable insurance market’ has, under John Neal, become nothing more than a ‘discussion document’ that syndicates can take or leave as they see fit. It is abundantly clear that John Neal prioritises profits at the cost of people and planet, and that under his leadership Lloyd’s policies fail to match its climate rhetoric,” said Lindsay Keenan, European Coordinator of Insure Our Future.

Neal further exposed his disregard for climate action by failing to make a clear commitment that Lloyd’s members would not insure the East African Crude Oil Pipeline and saying Lloyd’s has no current plans to adopt an exclusion policy for oil and gas expansion.

On the Adani Carmichael coal project in Australia, a source of significant controversy for Lloyd’s over the last two years, Neal said that “to the best of my knowledge” the project is no longer insured in the Lloyd’s market. While Neal encouraged syndicates not to underwrite Adani, he refused to give a clear commitment on its status inside Lloyd’s, both now and in the future.

“The #StopAdani campaign has done the work John Neal should have done, and convinced the vast majority of its insurers to commit to never insuring the disastrous Adani Carmichael thermal coal project. Now, Neal needs to come clean and officially clarify if the Lloyd’s market remains exposed to Adani, and make the promise to not insure the climate-wrecking project in the future. If Lloyd’s cannot take this basic step, then its ESG policies have failed their most simple test and Adani Carmichael will continue to be a stain on its reputation,” said Mia Watanabe, UK Campaigner at Market Forces

Lloyd’s stated commitment to transparency is contradicted by its actions. Neal said Lloyd’s expects its members to have robust net-zero ESG plans, but will not ask them to publish those policies. He confirmed that data on insured emissions will be collected at syndicate level, but published only as obscure market wide data. Neal tried to justify the lack of transparency by saying he didn’t want to put additional pressure on Lloyd’s members.

Neal stated many times in the meeting that UK competition law prevents him from mandating marketwide action. Previously, Lloyd’s excuse was that it didn’t have the power to require the implementation of its ESG policy, which was proved false by its own bylaws. Neal now points to competition law as the barrier preventing Lloyd’s from mandating its members stop insuring and investing in specific fossil fuel sectors.

Keenan added, “Neal has no intention of taking marketwide action and is using competition law as his latest excuse. However, it does raise a significant question that must be asked of the UK Competition and Markets Authority regarding whether there is any legal barrier to coordinated industry action to meet climate targets.”

The meeting concluded with Keenan’s challenge for Neal to invite Insure our Future members, climate scientists and impacted communities to meet with Lloyd’s Council and ESG committee, and for Neal to join him in a public debate to clarify and discuss Lloyd’s policies. Neal said he would consider each of these, and appeared to mean it.

Coal Action Network is proud to present our 2026 manifesto for Wales. With the Senedd elections taking place in May this year, Wales stands at a decisive moment. For over a century, coal has shaped Welsh landscapes, communities, and politics. Today, Wales has the opportunity to shape something very different…

As part of our Politics Unspun series we are unpacking politicians’ public comments on coal to challenge any misleading or incorrect messages. Todays’ focus is on comments made during a Westminster Hall debate in December 2025 about the oil refining sector. During the debate, Lee Anderson MP made some statements about coal…

The Government is reforming planning policy in England and thanks to thousands of our supporters asking for an end to coal extraction in the last consultation in 2024, they are now recommending that planners “should not identify new sites or extensions to existing sites for peat or coal extraction”…

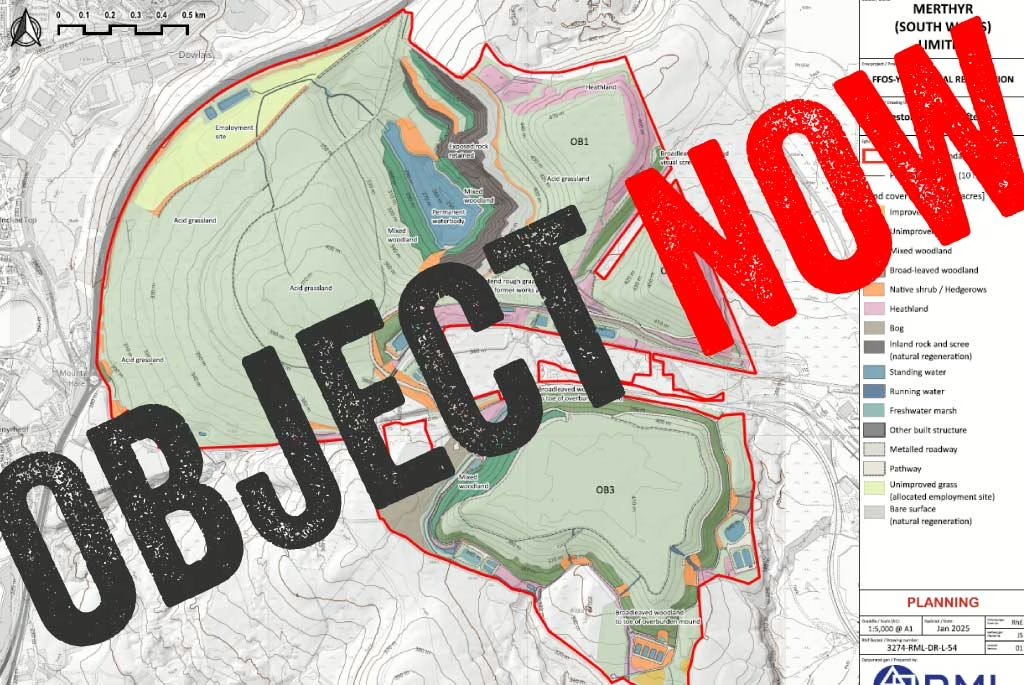

Merthyr (South Wales) Ltd mined for over a year illegally after planning permission for the Ffos-y-fran opencast coal mine ended in September 2022. During that year, it made record-breaking profits due to sanctions on Russia and other factors driving up the price of coal. But rather than using some of the profits from that ill-gotten coal…

In November 2024, the new UK Government announced its intention to legislate a ban of new coal mining licences – which we welcomed. Over a year later, the legislation is yet to be introduced, and the Government is not planning to include all types of extraction…

The UK steel and cement sectors (and to a lesser extent, bricks) are the largest users of coal following the closing down of the UK’s last coal-fired power station in September 2024. Check out our coal dashboard for our most recent coal stats including an industry break-down. We support the UK Government’s commitment to ban…

The steel industry produces 9-11% of the annual CO2 emitted globally, contributing significantly to climate change. In 2024, on average, every tonne of steel produced led to the emission of 2.2 tonnes of CO2e (scope 1, 2, and 3). Globally in 2024, 1,886 million tonnes (Mt) of steel were produced, emitting…

Last month we worked with Members of Parliament from various parties on a Westminster Hall debate about coal tip safety and the prohibition of new coal extraction licences. The debate happened 59 years and one day after the Aberfan tragedy which killed 116 children and 28 adults…

Successful, at-scale, examples already exist of cement works burning 100% fuel alternatives to traditional fossil fuels, including pilot projects using combinations of hydrogen and biomass (UK) and hydrogen and electricity (Sweden). Yet, innovations such as use of hydrogen and kiln electrification are…

Disgusting. I work at Lloyds and I am disgusted by the lack of leadership. We’ve gone backwards to the 80s with the appointment of Neal in many areas.

The idea that we can sit here and provide financial backing to these projects and act innocent is rediculous. Climate change threatens the Lloyds market itself through extreme weather events and other negative impacts, very short sighted from Neal. Members and employees of Lloyd’s should be in uproar at this since it’s your families and the future of Lloyds itself that a handful of people are responsible for.